Car Insurance Rates in the USA: What You Need to Know in 2026

Car insurance is a mandatory and significant expense for drivers in the United States. Whether you’re a new driver, a seasoned motorist, or planning to move to the U.S., understanding car insurance rates can help you budget effectively and choose the right coverage. Auto insurance costs vary widely depending on your location, driving history, vehicle type, coverage level, and more. This guide explains the average rates, what affects them, and how to find affordable coverage in 2026.

What Are Car Insurance Rates?

Car insurance rates are the premiums you pay to an insurance company in exchange for financial protection against damages and liabilities related to your vehicle. In most U.S. states, drivers are legally required to carry minimum liability coverage, while optional full coverage includes comprehensive and collision protection.

The amount you pay annually or monthly for auto insurance is called your insurance premium. Premiums are calculated based on risk factors associated with the driver and the vehicle.

Average Car Insurance Rates in the USA

As of 2026, car insurance rates in the United States continue to fluctuate due to inflation, repair costs, and local claim trends. According to recent industry analysis:

- The national average annual cost for full coverage car insurance is around $2,339 per year, which is approximately $195 per month for a typical driver with a clean record and good credit.

- For a policy that meets the state minimum legal requirements only, the average cost is much lower — around $629 per year or $52 per month.

These averages are a general indicator. Your personal rate may be significantly higher or lower depending on factors discussed below.

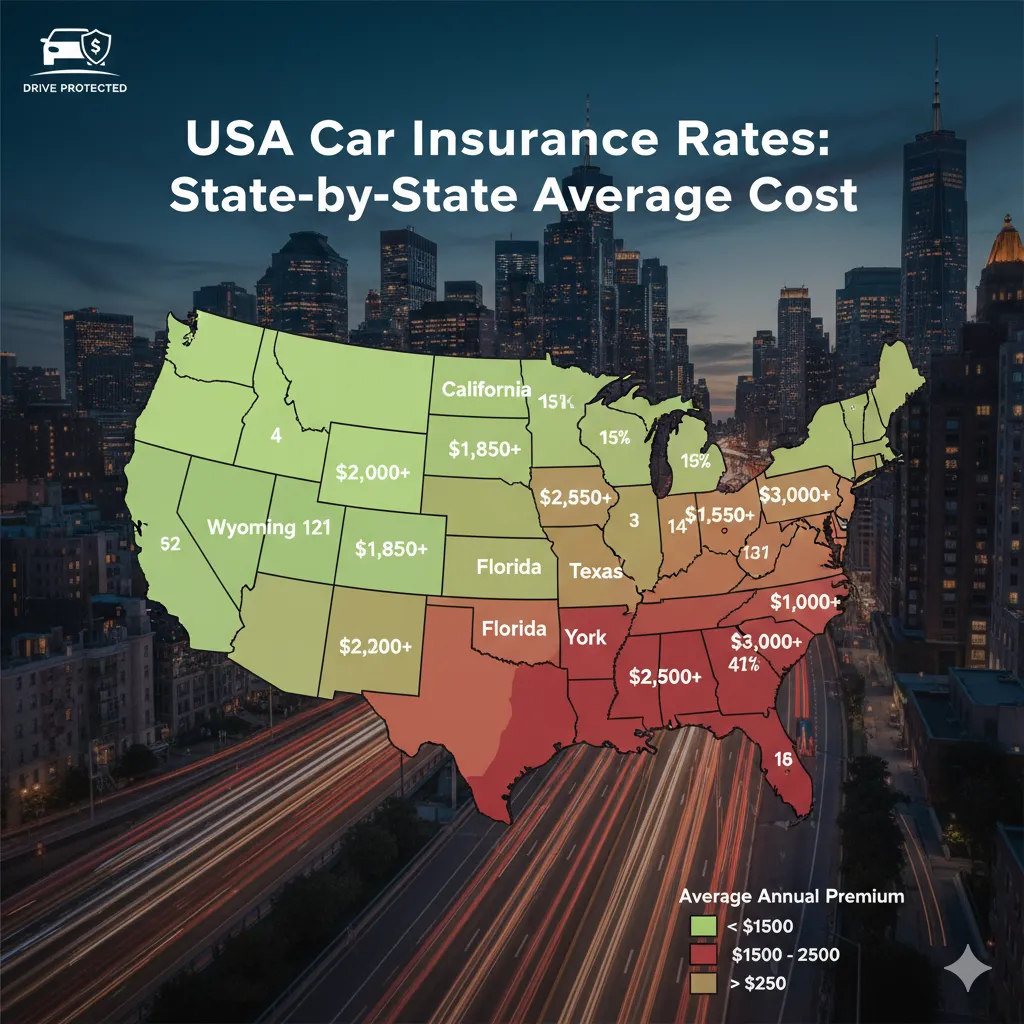

How Rates Vary by State

Car insurance is priced very differently from one state to another. This is because each state has different regulations, accident rates, weather patterns, medical costs, and repair costs — all of which contribute to how much insurers charge.

Recent data shows that states with the highest average car insurance costs include:

- Louisiana

- Florida

- New Jersey

- Texas

All of these states tend to have high claims frequency, expensive repairs, or more demanding legal requirements.

On the other hand, some of the least expensive states for auto insurance include:

- Wyoming

- Vermont

- Maine

- New Hampshire

These states generally have lower population densities, fewer accidents, and lower average repair costs.

Factors That Affect Your Car Insurance Rate

Your car insurance premium is based on many variables that help insurers estimate risk. Key factors include:

1. Driving Record

Drivers with clean records typically pay much less than drivers with speeding tickets, at-fault accidents, or DUIs.

2. Age and Gender

Younger and older drivers often pay higher premiums due to their higher risk profiles, while middle-aged drivers with experience often pay less.

3. Location

Urban areas with high traffic, theft, and accident rates usually have higher insurance rates compared to rural areas.

4. Type of Vehicle

Insurance costs vary based on the car’s make, model, age, and repair cost. Cars that are expensive to repair or replace, or that are statistically more likely to be stolen, usually cost more to insure.

5. Coverage Levels

Full coverage (liability, collision, and comprehensive) costs considerably more than minimum liability coverage.

6. Credit and Insurance Score

In many states, insurers use credit-based insurance scores as a factor in calculating premiums.

Trends in Car Insurance Rates

Car insurance rates have been rising steadily nationwide. Several recent reports show that:

- Insurance premiums have increased over recent years due to rising vehicle repair costs and more frequent claims.

- High medical and repair costs after accidents add to overall claim payouts, which insurers factor back into rate increases.

As a result, many drivers are paying more now than they did in previous years for similar coverage.

How to Lower Your Car Insurance Rates

While rates continue to rise, there are ways to reduce your auto insurance expenses:

- Compare Quotes Getting quotes from multiple insurance companies helps you find the best price for the coverage you need.

- Maintain a Clean Driving Record Avoiding traffic violations and accidents can significantly reduce your premium over time.

- Increase Deductibles Choosing a higher deductible can lower your monthly or annual insurance premium, though it means you pay more out-of-pocket if you need to file a claim.

- Bundle Policies Many insurers offer discounts if you bundle auto insurance with homeowners or renters insurance.

- Take Advantage of Discounts Many carriers provide discounts for students with good grades, defensive driving courses, low annual mileage, and more.

- Review Coverage Annually Insurance needs change. Regularly reviewing your policy ensures you’re not paying for unnecessary coverage.

Why Rates Differ So Much by State

Several underlying reasons explain why car insurance costs can vary so widely depending on where you live:

- States with “no-fault” insurance laws often have higher premiums because insurers must cover medical expenses regardless of who caused the accident.

- High population density and more accidents in urban states increase claim frequency.

- Weather-related risks such as hail, floods, and storms also affect insurance rates.

Final Thoughts

Car insurance rates in the USA are influenced by a complex mix of personal, vehicle, and regional factors. As of 2026, the national averages show that a full coverage policy costs several thousand dollars annually for most drivers, but these costs can vary dramatically by state and individual profile. Understanding how insurance companies calculate rates and what you can do to lower them will help you make better decisions and potentially save money.

Regularly comparing quotes, maintaining a good driving history, and choosing appropriate coverage levels are key steps toward affordable and effective auto insurance coverage in the United States.